dellmecopumps.ru News

News

8 Year Mortgage Rates Today

Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. As of August 31, , the average year-fixed mortgage APR is %. Terms Explained. 3. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Today's Mortgage Rates ; Year Fixed Rate. Rate: %. APR: %. Points Estimated Monthly Payment: $1, ; Year Fixed Rate. Rate: %. APR. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Quick start tip: Use the popular selections we've included to help speed up your calculation – a monthly payment at a 5-year fixed interest rate of %. Discover how much home you can afford with today's current mortgage rates & calculating your mortgage payment. Find your mortgage rate & apply today! Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. As of August 31, , the average year-fixed mortgage APR is %. Terms Explained. 3. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Today's Mortgage Rates ; Year Fixed Rate. Rate: %. APR: %. Points Estimated Monthly Payment: $1, ; Year Fixed Rate. Rate: %. APR. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Quick start tip: Use the popular selections we've included to help speed up your calculation – a monthly payment at a 5-year fixed interest rate of %. Discover how much home you can afford with today's current mortgage rates & calculating your mortgage payment. Find your mortgage rate & apply today!

Our Mortgage payment calculator can help determine your monthly payment and options to save more on mortgages. Visit Scotiabank online tool today! Fixed-rate mortgage. ; Promotional rate - 5 years. ; 6 years. ; 7 years. ; 8 years. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. 7/6 ARM, % (%), $2, added to closing costs, $2, ; year fixed, % (%), $ added to closing costs, $3, Mortgage Rates Continue to Drop. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue. See today's mortgage rates. Talk with a Home Lending Center representative about your options. Mon – Thurs: 8 a.m. – 10 p.m. ET Fri: 8 a.m. – 6 p.m. ET. Rates vary based on creditworthiness. All loans subject to credit approval. ↵. 8. A Homebuyers Choice loan of $, for 30 years at % interest and To see the current best Canada mortgage rates from the Big 5 Banks, click on the "Best bank rates" tab. dellmecopumps.ru Insights: There were no changes to fixed. As of Aug. 30, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. As of August 29, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. Current mortgage interest rates in California. As of Tuesday, September 3, , current interest rates in California are % for a year fixed mortgage. Fixed Rate Mortgages ; 5-Year Fixed High Ratio, % 3, % 2 ; 6-Year Fixed Rate, % 5, % 2 ; 7-Year Fixed Rate, % 5, % 2 ; 8-Year Fixed Rate. 5 Year Variable Closed. %. TD Mortgage Prime Rate %: %. %. TD You'll be making two extra principal and interest payments a year potentially. Mortgage Calculator ; Loan Term? years ; Interest Rate? ; Start Date ; Include Taxes & Costs Below ; Annual Tax & Cost. Property Taxes? · Home Insurance? · PMI. As of Tuesday, September 3, , current year mortgage rates are Ten-year mortgage rates follow prevailing interest rates, which rose steadily from. As of writing, the average mortgage rates from our selected lenders range from % to % for a 5-year fixed-rate mortgage. What are the Best Mortgage Rates. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. As we say goodbye to August, fixed mortgage rates are as low as they've been in a long time. As of August 28, , five-year fixed rates are below % at some. On Tuesday, Sept. 3, , the average interest rate on a year fixed-rate mortgage rose 16 basis points to % APR. The average rate on a year fixed-.

Is Gold Inflation Hedge

Gold isn't actually an inflation hedge. Unlike stocks, real estate, or bonds, it doesn't generate you any income by holding it. Plus the most. Gold, which is often used by investors as a standard option to hedge inflation, can be effective, but better alternatives exist. The best empirical inflation. Gold is a proven long-term hedge against inflation but its performance in the short term is less convincing. Gold has a negative expected real return and is an uncertain inflation hedge. Its price can move a lot unrelated to inflation, and you can have. Gold is often hailed as a hedge against inflation—increasing in value as the purchasing power of the dollar declines. However, government bonds are more secure. While the price of the yellow metal has an inversely proportional relationship to inflation rates, gold is less affected by recessions than many commodities. I feel like I always hear “buy gold” thrown around when people talk about recessions but have never made a purchase. Since , the price of gold has skyrocketed from US$ per troy ounce to an all-time high of US$ in April Gold protects investors against inflation because as their chosen currency devalues gold priced in that currency will tend to increase in price. The gold. Gold isn't actually an inflation hedge. Unlike stocks, real estate, or bonds, it doesn't generate you any income by holding it. Plus the most. Gold, which is often used by investors as a standard option to hedge inflation, can be effective, but better alternatives exist. The best empirical inflation. Gold is a proven long-term hedge against inflation but its performance in the short term is less convincing. Gold has a negative expected real return and is an uncertain inflation hedge. Its price can move a lot unrelated to inflation, and you can have. Gold is often hailed as a hedge against inflation—increasing in value as the purchasing power of the dollar declines. However, government bonds are more secure. While the price of the yellow metal has an inversely proportional relationship to inflation rates, gold is less affected by recessions than many commodities. I feel like I always hear “buy gold” thrown around when people talk about recessions but have never made a purchase. Since , the price of gold has skyrocketed from US$ per troy ounce to an all-time high of US$ in April Gold protects investors against inflation because as their chosen currency devalues gold priced in that currency will tend to increase in price. The gold.

So, is gold a good hedge against inflation? Gold has historically performed well during periods of high inflation, and many investors incorporate it into their. In addition, gold has an important role in any investment portfolio as both a tactical inflation hedge and a long-term strategic asset. This is because gold. Gold and other precious metals have historically held their value during times of rising inflation. Investing in the commodities themselves is not the only way. Gold has an inherently limited supply, which makes it an inflation hedge, but despite the commodity's reputation for being a safe-haven investment, gold is not. Many investors believe gold can be an excellent hedge against inflation, as it holds its value while currencies decrease in value. However, according to my. Many investors believe gold can be an excellent hedge against inflation, as it holds its value while currencies decrease in value. However, according to my. Looking back in time, gold served as a short-term inflation hedge during the s and s, where it had annualized returns of 28%. It's also been proven as a. The truth is that the yellow metal serves as an inflation hedge in the long run, but not in the short run. Gold and silver are two of the most popular and effective inflation hedges, and can help protect your wealth in times of economic uncertainty. Based on historical data, the real price of gold has been a more important driver of future nominal and real gold returns than the realized rate of inflation. price of gold will rise at the general rate of inflation. these conditions hold then in the long-run gold would be an effective hedge against inflation. be. Since , the price of gold has skyrocketed from US$ per troy ounce to an all-time high of US$ in April Is Gold a Good Hedge Against Inflation? Gold usually serves as a reliable inflation hedge. In fact, inflation data confirms that gold preserves its value over. An inflation hedge is an investment intended to protect the investor against—hedge—a decrease in the purchasing power of money—inflation. Is Gold a Good Hedge Against Inflation? Gold usually serves as a reliable inflation hedge. In fact, inflation data confirms that gold preserves its value over. So, is gold a good hedge against inflation? Gold has historically performed well during periods of high inflation, and many investors incorporate it into their. The price of gold and inflation summed up · The gold price is mainly driven by the value of the USD, market volatility, gold production, reserves, and jewellery. Traditionally, investments such as gold and real estate are preferred as a good hedge against inflation. However, some investors still prefer investing in. The truth is that the yellow metal serves as an inflation hedge in the long run, but not in the short run. Goldman Sachs'argue that gold lacks income-generating capabilities, making it a less compelling asset for long-term investors who seek regular returns.

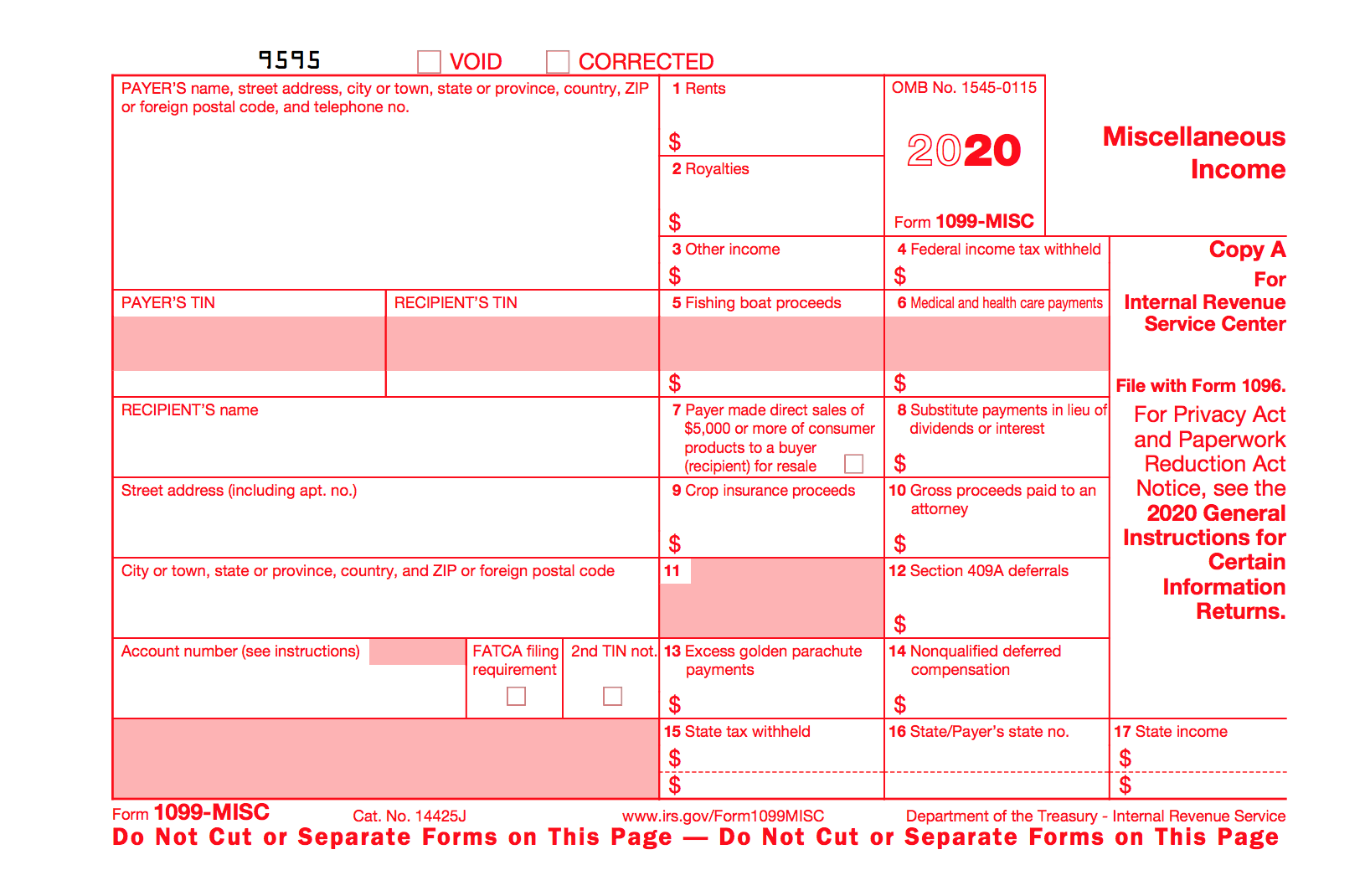

Who Needs A 1099 Form

Typically, this form is issued to independent contractors, janitorial services, third-party accounts and any other worker paid for services who is not on the. Form W-2 federal income tax withholding statements. 2. Form W-2G certain gambling winnings. 3. Form distributions from pensions, annuities, retirement. You should receive a Form NEC if you earned $ or more in nonemployee compensation from a person or business who isn't typically your employer. You. Keep Form G with your tax records. You may need it to calculate taxable income on your federal tax return. For more information regarding your federal tax. However, for the annual reporting of W-2G/s, DC still requires a separate filing for TY directly with OTR via bulk upload or online data entry on OTR's. A is a form used in the U.S. to report income other than wages or salaries from my limited understanding. In Canada, there are a range of. In general terms, Form MISC is issued to everyone but corporations. This includes individuals, partnerships and most professional business entities. An LLC. Businesses file a MISC when purchasing services (not goods) from unincorporated vendors (not corporations). For example: REPORT a $ purchase of computer. The K form specifically reports payments and transactions from online platforms, apps, or payment card processors. Typically, this form is issued to independent contractors, janitorial services, third-party accounts and any other worker paid for services who is not on the. Form W-2 federal income tax withholding statements. 2. Form W-2G certain gambling winnings. 3. Form distributions from pensions, annuities, retirement. You should receive a Form NEC if you earned $ or more in nonemployee compensation from a person or business who isn't typically your employer. You. Keep Form G with your tax records. You may need it to calculate taxable income on your federal tax return. For more information regarding your federal tax. However, for the annual reporting of W-2G/s, DC still requires a separate filing for TY directly with OTR via bulk upload or online data entry on OTR's. A is a form used in the U.S. to report income other than wages or salaries from my limited understanding. In Canada, there are a range of. In general terms, Form MISC is issued to everyone but corporations. This includes individuals, partnerships and most professional business entities. An LLC. Businesses file a MISC when purchasing services (not goods) from unincorporated vendors (not corporations). For example: REPORT a $ purchase of computer. The K form specifically reports payments and transactions from online platforms, apps, or payment card processors.

You must issue a MISC if you paid a non-employee individual or business (other than an incorporated business) $ or more to provide services. Any companies or business owners who make payments to contractors for services rendered, but do not withhold normal payroll taxes, must file a MISC form. That means that rents, attorney fees, crop insurance proceeds, proceeds from a fishing boat, and state-earned income still go under the MISC. Further. ADOR only requires submission of Form that report Arizona income tax withheld. Taxpayers only need to submit Form NEC if there is Arizona withheld. Form MISC is used by payers in business to report specified miscellaneous payments other than nonemployee compensation (that are mostly $ or more). Form. However, if the foreign worker performs any work inside the United States, you would need to file the For that purpose, you should have that foreign. Credit, debit and gift card companies may also send out a K. Other types of businesses generally don't need to prepare this tax reporting form. "Unless you. The basic rule is that you must file a NEC whenever you pay an unincorporated independent contractor—that is, an independent contractor who is a sole. ADOR only requires submission of Form that report Arizona income tax withheld. Taxpayers only need to submit Form NEC if there is Arizona withheld. forms report a taxpayer's non-employment income received throughout the tax year to the Internal Revenue Service (IRS). The IRS compares reported income on. A business that makes payments totaling $ or more to a nonemployee typically needs to file Form NEC. Also, any business that withholds federal income. To Which Calendar Year Does Form Reporting Apply for ? forms due in apply to payments made in the calendar year What is the Business. A Form NEC reports payments of at least $ in nonemployee compensation, a form often sent to self-employed persons or independent contractors. A Form is an official tax form that shows when income has been paid to someone who is not an employee. It's used by the IRS to check that everyone is. Forms W-2 and Filing by Employers and Others Making Reportable Payments · Rents and royalties of $ or more paid to a Wisconsin resident, regardless of. Learn about filing requirements for the different types of annual Forms reports of interest, dividends, and other taxable income with the Massachusetts. However, for the annual reporting of W-2G/s, DC still requires a separate filing for TY directly with OTR via bulk upload or online data entry on OTR's. These forms are available at dellmecopumps.ru ○ Do not submit s with zero SC Income Tax withheld. ○ Carriage Return and Line Feeds are required in. Learn about filing requirements for the different types of annual Forms reports of interest, dividends, and other taxable income with the Massachusetts. For every account that meets the Form K requirements, including non-profits, the IRS requires Square to report this information. According to the IRS.

What Credit Union Is Best

Providing better banking to Southern California and the Bay Area, with checking, mortgages, auto and home equity loans, credit cards, investments and more. Several factors come in to play when choosing which bank or credit union is right for you. Learn more about what you should consider before opening a new. Best credit unions · Best for no-fee checking: Alliant Credit Union · Best for ATM access: PenFed Credit Union · Best for high APY: Consumers Credit Union (CCU). SDCCU has been voted San Diego's BEST Credit Union, BEST Home Loan Provider & BEST Place To Work. Alliant Credit Union. Alliant offers an above-average interest rate for savings. Membership is not restricted; you can join with a $5 donation to a nonprofit. University Credit Union serves the banking needs to all employees, alumni, and students at the University of Miami, UHealth, Florida International University. Credit unions offer similar financial products as banks, but they are more affordable. Most people consider a credit union for car purchases because the rate is. Altra Federal Credit Union is a nonprofit financial cooperative with locations in eight states. Our members benefit from our competitive products and. WalletHub selected 's best credit unions in California based on user reviews. Compare and find the best credit union of Providing better banking to Southern California and the Bay Area, with checking, mortgages, auto and home equity loans, credit cards, investments and more. Several factors come in to play when choosing which bank or credit union is right for you. Learn more about what you should consider before opening a new. Best credit unions · Best for no-fee checking: Alliant Credit Union · Best for ATM access: PenFed Credit Union · Best for high APY: Consumers Credit Union (CCU). SDCCU has been voted San Diego's BEST Credit Union, BEST Home Loan Provider & BEST Place To Work. Alliant Credit Union. Alliant offers an above-average interest rate for savings. Membership is not restricted; you can join with a $5 donation to a nonprofit. University Credit Union serves the banking needs to all employees, alumni, and students at the University of Miami, UHealth, Florida International University. Credit unions offer similar financial products as banks, but they are more affordable. Most people consider a credit union for car purchases because the rate is. Altra Federal Credit Union is a nonprofit financial cooperative with locations in eight states. Our members benefit from our competitive products and. WalletHub selected 's best credit unions in California based on user reviews. Compare and find the best credit union of

First community Credit Union for six decades and counting, First Community has been working to build a stronger Houston. We are a full-service financial institution offering the best in checking and savings accounts, competitive auto loans, top mortgage rates and lending features. Find the best high-yield savings (HYSA) and high-yield checking accounts available and the best CD rates of Open an account online in minutes at. Credit unions typically offer lower closing costs for home mortgage loans, and lower rates for lending, particularly with credit card and auto loan interest. After a rigorous independent survey assessing everything from trust to digital services, UFirst is recognized by Forbes as the best credit union in our state. You can't go wrong with Chase in NYC. And yeah it's fairly easy to keep them fee free if you have any sort of income. You really forget they. Great NorthWest FCU has been providing products and services to our family of members since Join us! Membership open to all who live, work or worship. In The News. Sandia Area Federal Credit Union was recently named the top credit union in New Mexico in by Forbes Magazine. “This is such an honor and. Alliant ranks as the one of the largest credit unions in the nation, serving , members nationwide with more than $19 billion in assets. We offer better-. – TruWest Credit Union has topped the Forbes list of America's Best Credit Unions, ranking No. 1 in the state of Arizona. Forbes partnered with Statista, a. Six Years in a Row. BMI Federal Credit Union was voted #1 Best Credit Union in Central Ohio by The Columbus Dispatch CBUS Top Picks Awards for the SIXTH year in. Financial products and services for members across Nevada, including checking, savings, credit cards, mortgages, vehicle and personal loans, and more. Welcome to Members First Credit Union of Michigan. With credit union locations near you, we are ready to serve your financial needs. Learn more. Forbes recently named Suffolk Credit Union the best credit union on Long Island and the number two credit union in NY. Read more about these awards online. Delta Community Credit Union is listed twice among the nation's top financial services providers in GOBankingRate's list of the Best Banks and Credit Unions. At Best Financial Credit Union, you're a member with a share in everything we do as an institution. Our focus is exclusively on the financial well-being of. SDCCU has been voted San Diego's BEST Credit Union, BEST Home Loan Provider & BEST Place To Work. Best Reward Federal Credit Union is dedicated to meeting your financial needs and providing our members with excellent service as their trusted financial. A credit union is a not-for-profit financial institution that accepts deposits, make loans, and provides a wide array of other financial services and products. At Clark County Credit Union, we are excited to have been recently named the best credit union in Nevada by Forbesin their second annual Best in State awards.

Quick Emergency Loans Bad Credit

credit check and are very affordable in Canada! Quick, easy and reliable We offer highly affordable no credit check loans in Canada. CREDIT KNOW-HOW. Bad. With a more flexible repayment schedule than payday loans, our online fast cash loans can get you back on track as soon as tomorrow. Best Emergency Loans for Bad-Credit of September ; PenFed Credit Union. · % to % ; First Tech Federal Credit Union. · As low as % ; Prosper. fast cash you need today. If you are worried about bad credit, relax! You can still get one of our payday loans! REQUIRED ITEMS FOR PAYDAY LOANS. Most Recent. fast cash you need today. If you are worried about bad credit, relax! You can still get one of our payday loans! REQUIRED ITEMS FOR PAYDAY LOANS. Most Recent. Get help from Northstar Brokers' emergency loans Ontario. Options available like cash advances, payday loans, and loans for bad credit. Yes, securing an emergency loan with bad credit is indeed possible. A low credit score or poor history doesn't necessarily serve as a significant barrier to. Emergencies happen, regardless of your credit score. If you need an emergency loan for bad credit, there may be lenders that can help. As a bad credit borrower. Do you have poor credit or a non-traditional source of income? That's okay. Magical Credit provides bad credit loans to low-income households. We accept. credit check and are very affordable in Canada! Quick, easy and reliable We offer highly affordable no credit check loans in Canada. CREDIT KNOW-HOW. Bad. With a more flexible repayment schedule than payday loans, our online fast cash loans can get you back on track as soon as tomorrow. Best Emergency Loans for Bad-Credit of September ; PenFed Credit Union. · % to % ; First Tech Federal Credit Union. · As low as % ; Prosper. fast cash you need today. If you are worried about bad credit, relax! You can still get one of our payday loans! REQUIRED ITEMS FOR PAYDAY LOANS. Most Recent. fast cash you need today. If you are worried about bad credit, relax! You can still get one of our payday loans! REQUIRED ITEMS FOR PAYDAY LOANS. Most Recent. Get help from Northstar Brokers' emergency loans Ontario. Options available like cash advances, payday loans, and loans for bad credit. Yes, securing an emergency loan with bad credit is indeed possible. A low credit score or poor history doesn't necessarily serve as a significant barrier to. Emergencies happen, regardless of your credit score. If you need an emergency loan for bad credit, there may be lenders that can help. As a bad credit borrower. Do you have poor credit or a non-traditional source of income? That's okay. Magical Credit provides bad credit loans to low-income households. We accept.

At Speedy Cash, we offer a streamlined online application process with same-day approval. Furthermore, having a bad credit history can be a major hurdle when. Payday loans for bad credit in Ontario are a helpful option for people who have low credit scores and need money fast because they are designed for those times. If you are someone looking for urgent loans for bad credit, we are happy to help at Fast Loan with emergency loans whether you have a good or bad credit history. Offers two types of low-interest loans via their Mini Loan Program. To qualify for these loans, you must have a current income and a bank account with direct. How to get a bad-credit emergency loan. 1. Compare lenders. If you're wondering where to get an emergency loan for poor credit, you'll be pleased to learn. Apply for an emergency loan online from $1, - $20, This won't affect your credit score. What you get with every OneMain personal loan for emergencies. Cash advance loans are a reliable short-term solution for financial binds, regardless of how good or bad your credit may be. However, in order to apply for. When you have a poor credit score, getting credit check loans is a challenge. Unsecured Loans can help you with your monthly payments. With online loans bad. Offers two types of low-interest loans via their Mini Loan Program. To qualify for these loans, you must have a current income and a bank account with direct. Our loans in Canada. Bad Credit Loans · Cash Advance · Credit Consolidation · Emergency Loans · Loans with No Refusal · No Credit Check Loans · Online Loans. We are offering installment loans with no credit checks. Payday loan alternative. No credit checks. Bad credit accepted Get an Installment Loan Faster &. While we offer bad credit loans irrespective of having a low credit score, we still need assurance of your ability to repay the borrowed funds within the. Bad credit loans are personal loans that are available to borrowers with a low credit score, often around to Lenders who offer bad credit loans know. Bad credit loans are personal loans that are available to borrowers with a low credit score, often around to Lenders who offer bad credit loans know. Emoney Loans provides instant online loans in Canada. Apply fast approval including bad credit or no credit check. Quick and paperless payday loans. Our mission is to support as many Canadians as possible. Do you have limited means? Is your credit score low? Do you have bad credit? Don't worry: no credit. Installment loans are available in Oregon. When an emergency strikes and you need money fast, an online loan could be your best option. With LoanNow, we process loans just as fast as payday lenders. But our emergency loans don't generate even bigger emergencies down the line. Unlike payday. At Speedy Cash, we offer a streamlined online application process with same-day approval. Furthermore, having a bad credit history can be a major hurdle when. Even with bad credit, you can still qualify for some emergency loans, especially if you have a co-borrower or cosigner. If not, you may have to consider a.

Insurance Policy Surrender Value

If you surrender your life insurance policy for cash value, you may have to pay taxes on the earnings portion of the withdrawal. The earnings portion is the. One option could be to cash it out entirely, which would get you all the cash value you have built up, but which requires that you surrender your policy—so the. Surrender value refers to the amount a person would receive if they withdraw money from their own life insurance policy's cash value. If you want to surrender your permanent life policy because of the premium cost, consider using the cash value to cover your premium payments (#4, below). WAC Minimum cash surrender values for fixed premium universal life insurance policies. (1) The minimum cash surrender values shall be determined. To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. Then, subtract the fees that will. Typically, surrender fees range between 10% to 35% of the policy's cash value and decrease each year. Surrender value in insurance is the amount the insurance company pays to the policyholder when he/she decides to terminate the plan before maturity. If the. A policy's cash surrender value depends on the policy's duration, growth, and assets. Surrendering your policy earlier in the term may result in a lower cash. If you surrender your life insurance policy for cash value, you may have to pay taxes on the earnings portion of the withdrawal. The earnings portion is the. One option could be to cash it out entirely, which would get you all the cash value you have built up, but which requires that you surrender your policy—so the. Surrender value refers to the amount a person would receive if they withdraw money from their own life insurance policy's cash value. If you want to surrender your permanent life policy because of the premium cost, consider using the cash value to cover your premium payments (#4, below). WAC Minimum cash surrender values for fixed premium universal life insurance policies. (1) The minimum cash surrender values shall be determined. To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. Then, subtract the fees that will. Typically, surrender fees range between 10% to 35% of the policy's cash value and decrease each year. Surrender value in insurance is the amount the insurance company pays to the policyholder when he/she decides to terminate the plan before maturity. If the. A policy's cash surrender value depends on the policy's duration, growth, and assets. Surrendering your policy earlier in the term may result in a lower cash.

Cash Surrender Value is the amount available to a policyholder upon policy cancellation. Understand its role in life insurance planning. Insurance Policies). However, the surrender of an insurance policy or endowment contract for its cash surrender value, as distinguished from an exchange of. surrender value. If, however, the total face value of all life insurance policies on any person does not exceed $1,, no part of the cash surrender value. Some years ago it was more or less general practice to include the cash surrender value of life-insurance policies among current assets. This practice can, we. Cash surrender value is the amount left over after fees when you cancel a permanent life insurance policy (or annuity). 2. Not all types of life insurance. Why surrender your policy? You had a good reason when you bought your cash value life insurance policy. Now, be sure you have a good reason for getting. Accumulating cash value or surrender value in a life insurance policy can be a good way to protect your money in excess of your exemptions in bankruptcy. Instead of your beneficiaries receiving the death benefit, you as the policyholder will receive the cash value your whole life insurance policy has built up. The surrender value of a policy is computed as per the surrender clause mentioned in the policy terms and conditions. What are the consequences of surrendering. Traditionally, this extra premium was held in the form of a guaranteed cash value, which the insured could access via a policy loan or surrender. There are. The surrender value of a life insurance policy is the actual sum of money you'd receive if you tried to access the cash value of your policy. The surrender fee. You'll generally receive most or all of the cash value that has accumulated in your life insurance policy, but it may be subject to surrender fees and federal. The surrender value is determined by adding any accumulated dividends and unearned premiums to the current cash value amount and subtracting any outstanding. Why surrender your policy? You had a good reason when you bought your cash value life insurance policy. Now, be sure you have a good reason for getting. The cash surrender value on a whole life insurance policy is the amount that is paid out if a policyholder terminates the policy. This is typically the cash. The cash surrender value (cash value minus any fees and charges) is the sum of money an insurance company pays to a policy owner or an annuity contract owner if. The surrender value of a policy is computed as per the surrender clause mentioned in the policy terms and conditions. What are the consequences of surrendering. In insurance-speak, “surrender” means cancelling the policy with your insurer and requesting what's called the “surrender value” as a cash payout. To get your. Cash Surrender Value is a feature in a life insurance policy that allows policyholder to terminate the policy and receive a lump sum payment. However, your insurer may subtract funds for any loans or unpaid premiums on the policy. And, you may be charged additional "surrender fees," which could.

What Is Term Deposit Account

Key Takeaways · A time deposit is an interest-bearing bank account that has a date of maturity, such as a certificate of deposit (CD). · The money in a time. Most basic savings accounts allow us to withdraw our money whenever we want. But if we don't need the money straight away, we could get a higher interest rate. The Term Deposit Facility is a program through which the Federal Reserve Banks offer interest-bearing term deposits to eligible institutions. A term deposit is. Rates for term deposits greater than $1 million · 1 year, % p.a., % p.a., % p.a., % p.a. · 2 years, % p.a., % p.a., % p.a., % p.a. The pros and cons of investing in Term Deposits: Is it a smart choice? · Fixed returns · Safety and security · Suitable for short-term goals · Lower returns than. They also have minimum deposit requirements and earns you guaranteed returns with a fixed interest rates. Features of Term Deposits. Here are few of the key. A Term Deposit offers flexible tenure and has minimum deposit requirements while a Fixed Deposit has a longer tenure and offers benefits of compound interest. A fixed deposit (FD) is a tenured deposit account provided by banks or non-bank financial institutions which provides investors a higher rate of interest. A time deposit or term deposit is a deposit in a financial institution with a specific maturity date or a period to maturity, commonly referred to as its. Key Takeaways · A time deposit is an interest-bearing bank account that has a date of maturity, such as a certificate of deposit (CD). · The money in a time. Most basic savings accounts allow us to withdraw our money whenever we want. But if we don't need the money straight away, we could get a higher interest rate. The Term Deposit Facility is a program through which the Federal Reserve Banks offer interest-bearing term deposits to eligible institutions. A term deposit is. Rates for term deposits greater than $1 million · 1 year, % p.a., % p.a., % p.a., % p.a. · 2 years, % p.a., % p.a., % p.a., % p.a. The pros and cons of investing in Term Deposits: Is it a smart choice? · Fixed returns · Safety and security · Suitable for short-term goals · Lower returns than. They also have minimum deposit requirements and earns you guaranteed returns with a fixed interest rates. Features of Term Deposits. Here are few of the key. A Term Deposit offers flexible tenure and has minimum deposit requirements while a Fixed Deposit has a longer tenure and offers benefits of compound interest. A fixed deposit (FD) is a tenured deposit account provided by banks or non-bank financial institutions which provides investors a higher rate of interest. A time deposit or term deposit is a deposit in a financial institution with a specific maturity date or a period to maturity, commonly referred to as its.

Got a lump sum? Now you can earn up to % AER fixed interest* on your funds, simply by switching your savings to our Advantage Fixed Term Deposit Account. When you open a term deposit account, your money is invested at an agreed fixed interest rate for a fixed period of time (the 'term'). That means, once you. Maturity date or term: the length of time agreed upon between customer and bank over which the money will remain on deposit without the customer being able to. A term deposit is a fixed-term investment, including the deposit of money at a financial institution in an account. The term deposit investments generally carry. Term deposits let you invest for a set amount of time and get a fixed interest rate. They can be useful when saving for bigger items like a car or investing. A high interest savings account is a bank account designed to help your savings grow faster. Generally, it offers a higher interest rate compared to other. A Term Deposit is an agreement between a customer and the bank to place a fixed amount of funds for a fixed amount of time in an interest bearing account. % p.a. % p.a. % p.a. % p.a. % p.a. The above Term Deposit rates are available online and in branch for customers with a maximum. About term deposits A term deposit is an account where you lock away money for a set amount of time (a 'term') at a fixed rate. Terms can range from one month. Unlike term deposits which have a fixed interest rate, savings accounts generally have a variable interest rate, so will be dependent on market conditions. That. The designated settlement account can be either the institution's own master account or its correspondent's master account. For additional information, please. Term Deposit, also known as Time Deposit, is an investment which is made by parking a specific amount of money within a financial institution for a. Select 'Fixed Term Deposit' on the 'Accounts' tab. Choose your currency and term and select 'Apply'. Choose your debit account, deposit amount and select. Term deposit or fixed deposits are deposits, where the depositor makes a lump sum deposit at our time for a fixed term and receives payment thereof on maturity. Compared to other savings accounts, fixed-term investments generally offer a higher rate of interest than even a high-interest savings account, though whether a. What is a term deposit? Term deposits are a type of savings account that lets you invest funds for a specific term at a fixed interest rate. Interest is. A fixed deposit account allows customers to deposit money for a set period of time, thereby earning a higher rate of interest in return. These are of varying. The amount deposited in the FD earns interest at a fixed rate which is set at the time of the account opening. FD holders can choose to receive the interest. Investec offers competitive interest rates with our fixed term deposit investment account, guaranteed returns and allowing access to funds after a fixed. If you're often tempted to dip into savings, term deposits will stop you from being able to do so. And if interest rates on savings accounts are going down, a.

Grubhub Money

If you pay for it with your own money, you won't get reimbursed. When you arrive at the delivery address, drop off the food and get your tip in the app. Payment. Holy Cross Dining uses Grubhub to bring our students, faculty and staff a convenient and fast way to place orders for pickup. At $24 per hour, you could potentially earn $ a week on just over 8 hours a day. A little change can make a huge difference. A couple of other tips: Cash in. Verify your Mason credential and add Mason Money or other credit/debit cards as a payment solution. Grubhub Support — For questions about your Grubhub. Download the Grubhub app, if you do not have it installed already. Click on Account - then Campus dining - then Find my campus. Enter Marist College. Add your. Once you're on the store page, you'll see a big Get Cash Back button (you can't miss it). Click it and you'll be redirected to the store's website. Just add. GrubHub pays its drivers based on the amount of delivery orders they complete. The exact amount can vary depending on factors such as. However, receiving a GrubHub form depends on the date the payment was issued and not the date that the order was placed or fulfilled. So, if you have a. For example, while the minimum GrubHub payment per hour might be $12 per hour, the average GrubHub pay is potentially around $20 per hour. So, depending on the. If you pay for it with your own money, you won't get reimbursed. When you arrive at the delivery address, drop off the food and get your tip in the app. Payment. Holy Cross Dining uses Grubhub to bring our students, faculty and staff a convenient and fast way to place orders for pickup. At $24 per hour, you could potentially earn $ a week on just over 8 hours a day. A little change can make a huge difference. A couple of other tips: Cash in. Verify your Mason credential and add Mason Money or other credit/debit cards as a payment solution. Grubhub Support — For questions about your Grubhub. Download the Grubhub app, if you do not have it installed already. Click on Account - then Campus dining - then Find my campus. Enter Marist College. Add your. Once you're on the store page, you'll see a big Get Cash Back button (you can't miss it). Click it and you'll be redirected to the store's website. Just add. GrubHub pays its drivers based on the amount of delivery orders they complete. The exact amount can vary depending on factors such as. However, receiving a GrubHub form depends on the date the payment was issued and not the date that the order was placed or fulfilled. So, if you have a. For example, while the minimum GrubHub payment per hour might be $12 per hour, the average GrubHub pay is potentially around $20 per hour. So, depending on the.

Download the Grubhub app, if you do not have it installed already. Click on Account - then Campus dining - then Find my campus. Enter Marist College. Add your. The average Grubhub salary ranges from approximately $35, per year for Sales Associate to $, per year for Researcher. Average Grubhub hourly pay ranges. Your Grubhub order would not process. You can deposit more money on your campus card and PacificCash by clicking the Add Cash Now in the left side menu on www. Grubhub drivers are not paid hourly. For more information about how Grubhub drivers are paid, visit our Pay page. How to set up your Grubhub payment · 1. Go to dellmecopumps.ru · 2. Navigate to your payment dashboard · 3. Complete your W-9 form · 4. Confirm W To view details and activate the Grubhub+ ongoing offer, visit dellmecopumps.ru Previously a one-year trial that converted to a paid Grubhub+ membership. Become a Grubhub Driver and deliver customers the food they love from their favorite restaurants. With the largest restaurant and diner network, Grubhub. 1. Plan Your Routes. One of the best ways to maximize your earnings is to plan your routes. By planning, you can ensure that you're taking the most efficient. Grubhub app, and use Commodore Cash to quickly and easily make food purchases. Please note that Meal Money is exclusively for Campus Dining operations and. For example, while the minimum GrubHub payment per hour might be $12 per hour, the average GrubHub pay is potentially around $20 per hour. So, depending on the. Grubhub accounts. How do I sign into my Grubhub for Restaurants account? · How do I adjust my Grubhub account settings? ; Payments. What is Grubhub's payment. money allotted to the drivers even if I personally request that that money not be taken from them and if I ask that the tip remain the same since the driver. See for yourself how Grubhub can deliver profits. · Profit Calculator · Join Grubhub today to start boosting your profits.* · Don't leave money on the table. When in doubt, go for takeout—Grubhub has it all! Order food delivery from thousands of restaurants, including local spots and national chains. Grubhub app, and use Commodore Cash to quickly and easily make food purchases. Please note that Meal Money is exclusively for Campus Dining operations and. money allotted to the drivers even if I personally request that that money not be taken from them and if I ask that the tip remain the same since the driver. Download the Grubhub app and create an account, if needed. Tap Account > Campus Dining > Select your specific IU campus; Add CrimsonCard as a payment option by. How To Make More Money as a Grubhub Driver: 15 Tips and Tricks · 1. Understand that Grubhub needs you · 2. Use tax write-offs to maximize your earnings · 3. Explore Grubhub delivery partners' most commonly asked questions seeking support using the app, completing deliveries, getting paid, purchasing gear, and more!

Treehouse Courses

Treehouse World Adventure Park has many challenging ziplines, rope courses, activities and treehouses. Adventure birthday party, anyone? Treehouse Creative School is a platform of artistic workshops, courses and lessons organised by the professional artists working at Treehouse NDSM. From. The Course at Tree House. Golf at the Course at Tree House in Tewksbury is currently available every day. Tee times must be pre-paid and can be made in. The Golf Course reserves the right to determine and modify the fees for accessing the facilities, including green fees, golf club rentals, and golf cart. Tree houses for high ropes courses and adventure parks. Many of our business customers are operating commercial climbing and adventure parks and commission tree. Treehouse Mountain DGC Great shape. The new nine really completes the course. Park next to sheds by hole one. Be mindful of treehouse rental guests on. Treehouse is an online technology school that offers beginner to advanced courses in web design, web development, mobile development and game development. Online Courses. Bright Course is an educational video program that allows If you are a CURRENT Treehouse mom, please call us to have another video sent. Treehouse Courses · Rails Routes and Resources Course (How To) · Kotlin and Anko Course (How To) · dellmecopumps.ru MVC Forms Course (How To) · CRUD Operations with PHP. Treehouse World Adventure Park has many challenging ziplines, rope courses, activities and treehouses. Adventure birthday party, anyone? Treehouse Creative School is a platform of artistic workshops, courses and lessons organised by the professional artists working at Treehouse NDSM. From. The Course at Tree House. Golf at the Course at Tree House in Tewksbury is currently available every day. Tee times must be pre-paid and can be made in. The Golf Course reserves the right to determine and modify the fees for accessing the facilities, including green fees, golf club rentals, and golf cart. Tree houses for high ropes courses and adventure parks. Many of our business customers are operating commercial climbing and adventure parks and commission tree. Treehouse Mountain DGC Great shape. The new nine really completes the course. Park next to sheds by hole one. Be mindful of treehouse rental guests on. Treehouse is an online technology school that offers beginner to advanced courses in web design, web development, mobile development and game development. Online Courses. Bright Course is an educational video program that allows If you are a CURRENT Treehouse mom, please call us to have another video sent. Treehouse Courses · Rails Routes and Resources Course (How To) · Kotlin and Anko Course (How To) · dellmecopumps.ru MVC Forms Course (How To) · CRUD Operations with PHP.

The park is a unique climbing experience set in an environment that resembles an Ewok village or a Swiss Family Robinson treehouse. Adventure parks are designed. Treehouse Courses, Learning and Development · MANAGER DEVELOPMENT PROGRAMMES · Manager Development · Leadership Skills · Managing Contribution through Others. Library account holders may only have ONE account with Treehouse. Due to the popularity of this online resource, Treehouse accounts with no course activity. Course conditions: A very hilly and quite wooded design on the grounds of a cabin rental business that rents large treehouses for overnight stays. First two. For example, they teach you all the basics of CSS and Sass. But they don't go as deep as "The Advanced CSS/Sass" course on Udemy, which is ~ Enjoy stunning ocean views and a 7-course private chef dinner hosted by our award-winning restaurant in The Treehouse Maui. Course outline · Choosing your space, planning your structure · Building your platform (working through a single-trunked platform example) · Beams & Joists, and. 17 likes, 0 comments - norwoods_treehouse on September 5, "Five courses specially curated by chef Dennis, five Foley Family wines. Experience Texas TreeVentures, the aerial adventure course in The Woodlands, TX. Featuring nearly challenging elements in a beautiful natural setting. Yes, Team Treehouse is legit. It has a massive library of courses covering a wide variety of subjects such as PHP, JavaScript, and Cascading Style Sheets (CSS). Treehouse or (Teamtreehouse) is an online technology school that offers beginner to advanced courses in web design, web development, mobile development and. Ahu tangata, ahu mahi - Connecting people with industry · Hot Courses · Security. GED Course Subjects. Treehouse Learning accent tree graphic (2).png. You will receive instruction in all content. TREEHOUSE WORKSHOPS · GANESHA ORACLE CARD READING BEGINNER WORKSHOP by Janjan ($) · Human Design Beginner Course Lv. · GANESHA Blessing Workshop by Janjan ($. On-site Courses. Thrift Store. Layette & Car Seat Program. Online Courses. Mommy Meetings. The Treehouse offers educational programs Monday-Thursday from Library Card Required. Treehouse is an online video and interactive learning platform with a focus on the design and development of websites, mobile and web. Tree House Brewing serves up tee times by David DeSmith. New England's Tree House Brewing is rolling out another barrel of fun—a brewery with a golf course. List of best Treehouse online courses. Start with top Treehouse courses courses and mooc with certifications. Also get certificates on course completiton. The Tree House Trail is a netted course designed for kids ages 3 and up. Moving from platform to platform amongst the trees, kids will navigate a series of fun.

Interest Refi Rates

Check today's mortgage rates for refinancing to get cash out, pay your mortgage off faster and more. Connect with us to estimate your personalized rate. Check out HSBC's mortgage refinance rates for fixed-rate and adjustable-rate mortgages. See if you could decrease your mortgage costs, today. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Fixed-Rate Mortgages: Conforming, High-Cost Area ; % · % ; % · % ; · Here are today's mortgage rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. We update the interest rate table below daily, Monday through Friday, so you have the most current refinance rates available. Use our mortgage calculator to get. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Compare rates for the refinance loan options below. The following tables are updated daily with current refinance rates for the most common types of home loans. Check today's mortgage rates for refinancing to get cash out, pay your mortgage off faster and more. Connect with us to estimate your personalized rate. Check out HSBC's mortgage refinance rates for fixed-rate and adjustable-rate mortgages. See if you could decrease your mortgage costs, today. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Fixed-Rate Mortgages: Conforming, High-Cost Area ; % · % ; % · % ; · Here are today's mortgage rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. We update the interest rate table below daily, Monday through Friday, so you have the most current refinance rates available. Use our mortgage calculator to get. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Compare rates for the refinance loan options below. The following tables are updated daily with current refinance rates for the most common types of home loans.

Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Borrowers with a high credit score are seen as a less risky investment to lenders, which qualifies them for lower mortgage interest rates. In the months or. You might lower your rate and payment by refinancing your home! With a Conventional loan, you can get a competitive interest rate when you have good credit and. The current average year fixed refinance rate climbed 10 basis points from % to % on Thursday, Zillow announced. The year fixed refinance rate on. Term, Rate, APR, Principal & Interest Payment ; 15 Yr Fixed Refinance, %, %, $1, ; 30 Yr Fixed Refinance, %, %, $1, Are you looking for the best interest rate possible to refinance your home? So are we. Learn about interest rates in Mr. Cooper Home Loans' handy. An escrow (impound) account is required. The rate lock period is 60 days and the assumed credit score is At a % interest rate, the APR for this loan. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. Today's Mortgage Rates. Mortgage rates change daily based on the market. Here are today's mortgage rates. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. A Military Choice loan of $, for 30 years at % interest and % APR will have a monthly payment of $1, Taxes and insurance not included;. See current mortgage refinance rates from Discover Home Loans. Low fixed rate loans come with $0 application fees, $0 origination fees, $0 appraisal fees. Here are today's refinance rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. Explore today's mortgage rates and compare home loan options. When you're ready to apply, call Navy Federal at and get pre-approved for a. Current refinance rates by loan type ; year fixed rate refinance. %. % ; year fixed rate refinance. %. % ; year fixed rate refinance. What are current mortgage refinance rates? Find and compare today's refinancing rates in your area. Check our current mortgage refinance rates. They're our lowest available, with a% interest rate discount when you Bank with Key or when you sign up for. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much. Current Mortgage Refinance Rates As of August 30, , the average mortgage refinance APR is %. Terms Explained.